Recent Developments in Healthcare: Technology, Financing and Regulation

By Arun Sreelalan Iyer

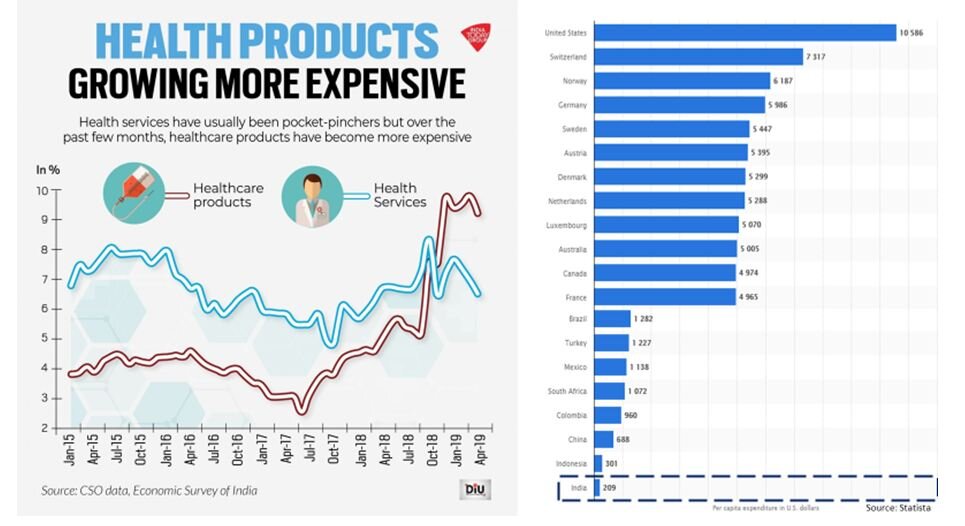

The current pandemic has brought healthcare sharply into focus and into everyone’s consciousness.Compared to developed economies, emerging economies like India, Brazil, Russia, South Africa and Mexico that have been affected badly by the virus have poor healthcare infrastructure and high population density which exacerbate risks. Much has already been written about India’s woefully low expenditure on healthcare (1.29% of GDP in FY20) and inadequate capacity (~0.55 to 0.7 beds per 1000 population). These topics have been debated in detail in other forums and will not be discussed here. Instead, this article will focus on some recent changes in the landscape and healthcare ecosystem in India.

India’s spending on Healthcare and capacity per 1,000 persons

Current Situation

Until the pandemic, Indians generally didn’t think about healthcare too much, and ‘healthcare’meant different things for different individuals and families. For some, a monthly visit to a general physician, diabetologist, or cardiologist was the norm. Visits to dentists aren’t the recommended semi-annual appointments for regular checkups and are instead emergency procedures when something needs fixing urgently.

There are several ‘soft’ factors for this situation which are complex and intertwined, including general apathy, lack of discipline and misplaced priorities, and these are no less important or impactful that the ‘hard’ factors. However, in this articlewe will briefly discuss some of the more tangible factors for the current state of healthcare in India, and how these are evolving.

Problems faced by Indians utilizing healthcare

Several reasons underlie Indians’ disinclination and inability to avail of primary, secondary or tertiary healthcare services.

Capacity constraints

The installed capacity for healthcare facilities per capita in India is extremely low, making it difficult for people to receive care. This results in Indians not seeking medical care even when required.

Access, Distribution and Quality

India’s healthcare infrastructure consists of a combination of state and central-government run public hospitals and private hospitals. The quality of equipment, personnel and care vary widely between the public and private hospitals, and between individual hospitals within these two broad segments.

As with many other public services, healthcare capacity is unevenly distributed in the country. Most hospitals and clinics are located in urban centers, and the rural population is poorly served. The relatively richer southern and western states largely have higher capacity than the northern and eastern states.

Cost and Financing

The lack of capacity and difficulty in access adds friction to price discovery, which drives costs up. The cost of healthcare services in India can be prohibitive and can cause immense financial pressure on families requiring specialized tertiary healthcare. According to some estimates, nearly 20% of Indian families incurred healthcare expenses exceeding their annual family income (2018).

Healthcare costs have been growing at nearlydouble the rate of retail inflation over the last few years (up to 7%), whereas GDP growth – which can be taken as a rough yardstick for income growth – has been below 4.5% for several quarters now.

The high costs are exacerbated by a lack of financing options. According to reports, less than 20% of Indians had any form of health insurance. Over 60% to as much as 75% of healthcare costs are borne out of pocket.

Trust and Transparency

There are 5 major participants in the healthcare ecosystem

1. Patients

2. Medical Practitioners (doctors, nurses, technicians)

3. Healthcare Provider Organizations (labs, clinics, hospitals)

4. Pharmacies and Pharmaceutical companies

5. Financiers (Health Insurers, Loan providers etc.)

Insurers and healthcare provider organizations resort to dense legalese and byzantine claims processes to control expensive litigation risks. The policy exceptions and medical tests not included in the insurance in turn drive up costs for the policyholder, who in turn mistrustsmedical practitioners and healthcare provider organizations as being avaricious and unscrupulous.

Hence, due to a complex tangle of reasons, the trust between the participants in the ecosystem is extremely low. Each participant has its own vested interests and wariness of the other four, and a highly opaque environment with low transparency makes it very hard to address the trust issues.

Indian Healthcare - Problems

Need of the hour

There is an urgent need for interventions that address the problems listed above. These would be a combination of policy and market interventions.

Specifically, the interventions need to:

Leverage existing capacity for healthcare to address a larger audience, and expand capacity

Drive investment in healthcare for public and private organizations while improving financial outcomes for the participants

Produce better healthcare outcomes for individuals at affordable price-points and gain their trust and confidence

Current Developments

We will look at three distinct – yetinterrelated – recentdevelopments that impact the problems mentioned above. These developments are expected to evolve into the required interventions to address the problems in Indian healthcare.

Levers of Healthcare Disruption

Technology

1.1 Telemedicine Solutions

The COVID-19 pandemic has accelerated the development and adoption of technology solutions for healthcare e.g. Telemedicine. These were in the works for several years, and the pandemic provided the push for organizations to complete development of their Telemedicine solutions and bring them to market. Today, several major hospital chains and healthcare service providers offer Telemedicine solutions.

1.2 Smart devices

Smartphones and smartwatches are becoming increasingly intelligent and are equipped with sensors and technology to track various physiological bio-markers. Most smart devices now allow users to track the number of steps walked, hours slept, body temperature and pulse on a real-time basis. Advanced smartwatches monitor the wearer’s glucose levels, body fat, and oxygen levels as well.

1.3 Optical Character Recognition (OCR)

OCR technology has widely varied applications. Recently, the quality and accuracy of OCR has increased significantly, and is over 99% now. This means that over 99% of text on a page can be successfully read and digitized by easily-available OCR techniques. The OCR techniques can be used with both printed and handwritten text content.

This allows users to digitize their medical lab reports and prescriptions by simply clicking a photo of the document and uploading it to an OCR service, usually through a smartphone app. The app can then provide the user the option of storing all their medical documents securely in a digital vault for easy reference and traceability.

1.4 SNOMED-CT

Medical documents are filled with medical jargon. Until recently, these used nonstandard terminology, with multiple terms being used to describe a single item of information.

For example, a cough can also be described as tussis, and a blood sugar test may be termed Blood Glucose, Plasma Glucose, or PPG. This makes it difficult for machines to track trends of test values for reference and decision making.

The Systematized Nomenclature of Medicine – Clinical Terms (SNOMED-CT) is a standardized computer-processable taxonomy of terms to describe anatomy, diseases, procedures, microorganisms and other medical terms.

SNOMED-CT allows computers to correlate terms in medical documents from unrelated medical service providers and present a comprehensive view of a person’s health to themselves or to a doctor.

SNOMED-CT is being increasingly adopted by major hospitals and labs in the Healthcare ecosystem, though not mandated by regulation yet.

1.5 Machine Learning and Analytics

Applying the technologies described above allows Healthcare Tech organizations to gather large amounts of data about individuals and patients. This data can be mined with advanced Machine Learning and Analytics algorithms to identify patterns and segment customers. Companies can develop customized, personalized offerings tailored to an individual user’s profile using the insights thus gained.

For example, a customized insurance policy with a suitably adjusted premium can be provided to an individual who regularly walks 10,000+ steps a day but has mildly high blood pressure, as indicated by the data from their smart devices, by applying appropriate machine learning and risk-management models.

Financing

India needs significant private investment as well as boosting of public expenditure on healthcare.

As mentioned earlier, very few people in India have any form of Health Insurance, and over 60% of medical expenses are borne out of pocket, with unexpected large expenses sometimes exceeding a family’s annual income.

After food and grocery delivery, healthcare-tech startups are seeing increased interest from financiers and venture capitalists. Healthcare-tech startups like Practo, mFine, Cure.fit, Pharmeasy, 1mg and others have seen significant investor interest from 2016-17 onwards.

This investment will be used to increase reach of healthcare services to comparatively far-flung regions, and to make access to healthcare affordable for the Indian middle-class.

A combination of fine-granular customer segmentation (possible due to advanced analytics and machine learning technology) and innovative business models have enabled newer financing models to make healthcare more affordable to end-consumers.

Health insurance distribution has increased significantly in the last few years and is available on digital channels which eliminate commissions to intermediaries and agents. Over-the-counter (OTC) drugs and prescription medicines are available to consumers at attractive price discounts from pharmacies and healthcare-tech startups.

Insurance premium payments are possible via online payment modes like UPI, and through loans serviced via Equated Monthly Instalments (EMIs), easing the cashflow burden on individuals and families. Improved technology integration between insurers and healthcare provider organizations enables faster claim processing and cashless treatment, easing cashflow burden on individuals.

Regulation

The Insurance Regulatory and Development Authority of India (IRDAI) is the governing body overseeing policies and practices of insurers. In the last 3-4 years, several significant steps have been taken by IRDAI to improve transparency and build trust with consumers.

3.1 Simplification

Until recently, the regulation regarding insurance coverage for pre-existing conditions and applicability to certain procedures was murky and unclear. Dense and complicated language in the insurance policy served more to conceal information from than to educate customers. This led to nasty surprises when the policyholder tried to utilize the benefits of the policy, eroding trust in the system and increasing financial burden on the individual.

Recently, steps have been taken by IRDAI to simplify the technical and legallanguage and features of policies so that the meaning and applicability is consistent across insurance providers. This has helped demystify the terms of health insurance and build trust with customers.

3.2 Standardization

The Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (PMJAY) program aims to provide free health coverage to nearly 40% of Indian households. Under this program, IRDAI has mandated that all health insurers provide an Arogya Sanjeevani Policy - a standardized health insurance policy with a fixed sum insured and applicability terms.

Since the plan is standardized, the issue of lack of information and transparency is eliminated, and customers can choose their health insurance provider based on cost, availability, and service quality factors with the confidence that they will not face nasty surprises when attempting to utilize the insurance plan.

3.3 Digitization and Interoperability

NITI Aayog’s India Stackand JAM – JanDhan + Aadhaar + Mobile – were instrumental in providing financial inclusion to nearly a billion Indians, and powering the simplified United Payments Interface (UPI) for easy money transfer using just a smartphone.

Riding on this success, NITI Aayog and the National Health Authority (NHA) – anattached office of the Ministry of Health and Family Welfare (MoHFW) – havepublished a working paper for the National Health Stack (NHS).

The NHS consists of subsystems to enable seamless interoperability between primary, secondary and tertiary care organizations and insurers. It aims to achieve superior healthcare outcomes for individuals with pricing transparency and protection against data theft and fraud.

Update 15-Aug-20:

During the Independence Day speech on 15-Aug-20, Prime Minister Narendra Modi launched the National Digital Health Mission (NDHM) and announced the National Health ID (NHID). The NHID is created using a person’s basic details, mobile number and Aadhaar Number, and is used to make a person’s healthcare records across service providers available digitally. The NHID is identification and security component of the NHS.(End Update 15-Aug-20)

3.4 Telemedicine

On 25-Mar-2020, the day after the announcement of the nationwide lockdown, the MoHFW published guidelines for practicing Telemedicine – a form of doctor consultations conducted remotely over a voice or video call. The guidelineshad been under review for some time, and the pandemic accelerated their formalization.

Hospitals and healthcare-tech startups have quickly adopted the guidelines to provide Telemedicine solutions with a doctor network. With increased acceptance, transparency and implementation of NHS, the adoption and usage of Telemedicine solutions is expected to increase significantly.

Update 15-Aug-20: In November 2019, the Center for Development of Advanced Computing (C-DAC) launched two online platforms eSanjeevani and eSanjeevaniOPD to be adopted individual state governments. These platforms are part of the MoHFW’s National Teleconsultation Service initiative to provide a nationwide platform for online doctor-to-doctor advisory and patient-to-doctor consulting respectively.

As on date, 23 Indian states covering 75% of the population have adopted the eSanjeevaniplatforms, and have clocked over 10,000 consulting hours. C-DAC is an R&D organization of the Ministry of Electronics and Communication Technology (MeitY).(End Update 15-Aug-20)

3.5 Enhanced plans

Until recently, due to a combination of taxation and regulation, individual health insurance was used only when the insured person was admitted to a hospital for treatment i.e. only for serious injuries or afflictions. Some insurers had attempted to offer Outpatient (OPD) reimbursement plans, but these have not been successful.

Recently IRDAI has begun discussions on allowing health insurers to create plans that include hospitalization cover, OPD benefits, cashless facilities at network hospitals and discounts on medicines from pharmacies. This would address the far more common scenario of regular outpatient consultations with doctors or purchasing medication for chronic illnesses than being admitted into a hospital.

Outcomes

The technology, financing and regulatory developments described above have several beneficial outcomes, and lay the path for further improvements.

The Telemedicine solutions being developed address the issues of capacity and access with reasonable quality, as the expertise of highly trained medical professionals located in urban areas becomes available to semi-urban and rural areas.

Regulatory transparency and standardization encourage competition among insurance providers to make operations efficient and optimizecosts, and pass on these benefits to the customers.

The NHS framework combined with data from smart devices enables health insurers to create customized plans with proper due-diligence and improved risk-management strategies to improve their revenues and profitability.

The enhanced insurance plans combined with technology and financing allow health insurers to create personalized plans for individuals who would otherwise have been regarded as uninsurable by including appropriately priced OPD and pharmacy discount components as benefits.

Hence, the developments described above address the pressing needs detailed earlier, and lay the groundwork for solving the core problems plaguing healthcare in India.

Summary and Conclusion

The COVID-19 pandemic has accelerated the change and adoption of solutions which have been in the works for some time, but could not come to fruition due to lack of progress in one or more of these areas.

The 2020s will be a decade of significant change and evolution in the Healthcare industry landscape globally, and especially in India. The state of technology and adoption of best practices in business models and regulation have melded to unlock hitherto impossible scenarios for superior outcomes for all stakeholders in the ecosystem.

Disclosure: The author of this article (Arun Sreelalan Iyer) is an employee at Bajaj Finserv Health Ltd., a subsidiary of the Bajaj Finserv Group. Visit https://healthrx.co.in/ for details.